Vancouver, Canada — Mawson Resources Limited (“Mawson” or the “Company”) (TSX:MAW) (Frankfurt:MXR) (PINKSHEETS: MWSNF) is pleased to announce its entry into the Tier 1 goldfields of central Victoria, Australia, via a multifaceted agreement with major landholder Nagambie Resources Limited (NAG:ASX) (“Nagambie”). Mawson’s technical team are consistently reviewing opportunities with a view to generate value for Mawson shareholders through project acquisition, exploration and divestment. The Company believes its Finnish assets and newly acquired Australian assets are a natural fit, bringing together a high-quality gold exploration portfolio in two safe and mining friendly jurisdictions.

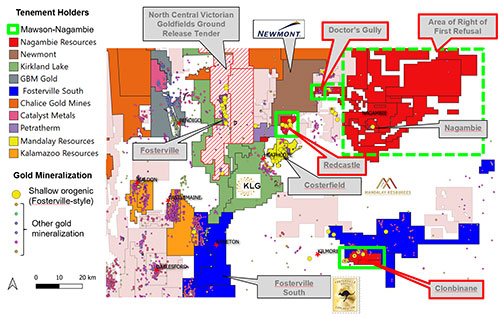

“Today’s acquisition of gold assets in Victoria, Australia, represents an exciting new opportunity for Mawson. It provides for the outright purchase and joint venture of three high-grade, Fosterville-style (shallow-orogenic or epizonal) exploration projects with numerous historic mines, that lack drill testing to depth, together with a right of first refusal on one of the largest land packages (2000 square kilometres) of high priority exploration ground in the State,” commented Mr. Michael Hudson, Chairman and CEO. “Victoria is one of the world’s largest orogenic gold provinces, with more than 80 million ounces of gold mined since the 1850s. Following the recent high-grade discovery success at Kirkland Lake Gold’s Fosterville mine, the significant potential of shallow orogenic deposits is now better understood.”

| Webcast Conference Call The Company will host a webcast conference call to review the acquisition on Thursday, January 30, 2020 at 8:00am ET. Those wishing to join the call can do so using the telephone numbers listed below. The call will also be webcast and available on the Company’s website at www.mawsonresources.com. Date: Thursday, January 30, 2020 at 8:00am Eastern Time | |

| Participant numbers | Toll Free: 844-602-0380 International: +1 862-298-0970 |

| Replay Number | Toll Free: 877-481-4010 International: +1 919-882-2331 Replay Passcode: 58280 |

| Event Link | https://www.webcaster4.com/Webcast/Page/2197/32999 |

Transaction Highlights:

Acquisition of three Fosterville-style high-grade gold assets in Victoria, Australia:

- Clonbinane (100% Acquisition)

- Mawson will acquire 100% of the shares of Clonbinane Goldfield Pty Ltd (“CGPL”), a 100% subsidiary of Nagambie and the holder of the Clonbinane mineral tenements (“Clonbinane”), for consideration of A$500,000 cash and 1.0 million Mawson Shares. Mawson will also pay Nagambie A$28,000 to replace environmental bonds.

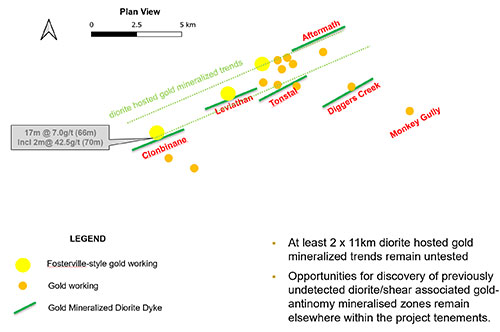

- Clonbinane is a shallow orogenic (or epizonal) Fosterville-style project. Gold mineralization is hosted within, or proximal to diorite dykes with mineralization continuing along structures that extend into the sedimentary country rock.

- Mining commenced in 1880s with total production being reported as 41,000 oz gold at a grade of 33g/t gold.

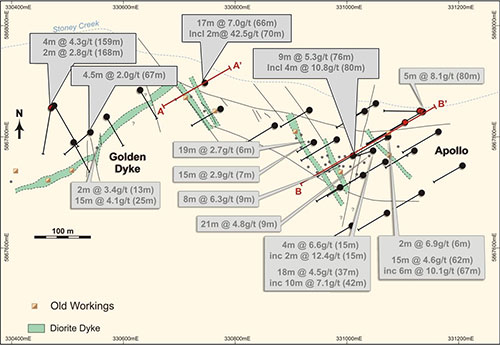

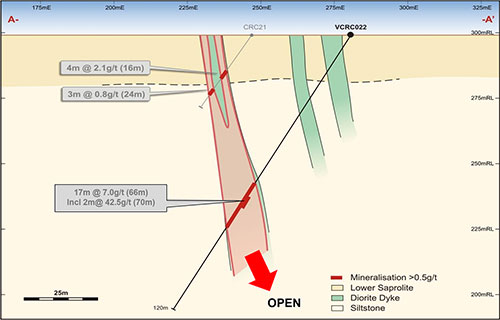

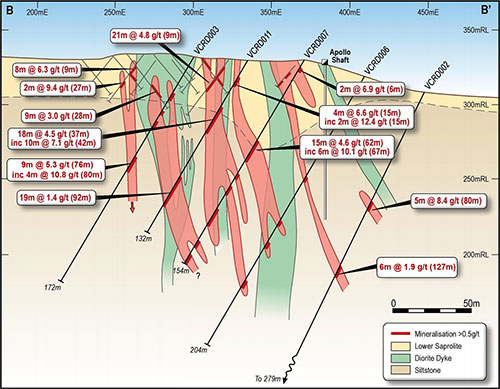

- Two small reverse circulation (“RC”) and diamond drill campaigns in 1993 and 2008 tested the system between 40 to 100 metres vertical depth over an 800 metre strike (Figures 2-5). Select historic drill results at 0.5g/t gold lower cut included 17 metres at 7.0g/t gold and 0.8% antimony from 66 metres (VCRC022), 38 metres at 2.8g/t gold from 15 metres (VCRC011), 27 metres at 3.7g/t gold and 0.46% antimony from 3 metres (CRC013), 2 metres at 42.5g/t gold and 1.0% antimony from 70 metres (VCRC022). These historical data have not been verified by Mawson and are quoted for information purposes only.

- The dyke and historic mine trend continues for 11 kilometres and remains undrilled.

- Redcastle (Option and Joint Venture)

- Mawson will have the right to earn an up to 70% joint venture interest in Nagambie’s Redcastle exploration licence (“Redcastle”) by incurring A$1,000,000 in expenditures on Redcastle over a 5 year period.

- Redcastle is a shallow orogenic (or epizonal) Fosterville-style historic high-grade project located 7 kilometres along strike from Mandalay Resource’s Costerfield mine and on a parallel structure, 24 kilometres east of Kirkland Lake Gold’s Fosterville mine (Figure 1).

- There are few reliable production records of the early mining at Redcastle; however, high grades of gold and associated stibnite were recorded from nearly all mines, which were only worked to an average of 55 metres depth within a 5 kilometre by 4 kilometre area. The Redcastle Gold Mining Company is reported to have produced 35,000 ounces of gold from Clarke’s Reef at a grade of 33g/t gold.

- Previous exploration has exclusively focussed on heap leachable near-surface gold and the project remains untested at depth.

- Doctor’s Gully (Option and Joint Venture)

- Mawson will have the right to earn an up to 70% joint venture interest in Nagambie’s Doctor’s Gully retention licence (“Doctor’s Gully”) by incurring A$1,000,000 in expenditures on Doctor’s Gully over a 5 year period.

- Doctor’s Gully is a shallow orogenic (or epizonal) Fosterville-style gold mineralized district located 13 kilometres northeast of Redcastle (Figure 1). The Doctor’s Gully retention licence covers a smaller area of 4 square kilometres with 21 historic gold showings and mines. Modern mining has focused on extracting oxide gold.

- RC drilling in 1988, which has never been followed-up, intersected 7 metres @ 4.1g/t gold from 40 metres (WHP7), 8 metres @ 3.2g/t gold from 40 metres (WHP26) and 1 metre @ 14.6g/t gold from 62 metres (WHP26). These historical data have not been verified by Mawson and are quoted for information purposes only.

- Like Redcastle, previous explorers at Doctor’s Gully have focussed exclusively on heap leachable near-surface gold and the project remains untested to depth.

Strategic 10% equity investment into Nagambie:

- Mawson will subscribe for 50.0 million ordinary shares of Nagambie (“Nagambie Shares”), which will represent a 10.0% shareholding in Nagambie. As consideration, Nagambie will receive 8.5 million common shares of Mawson (“Mawson Shares”), which will represent approximately 4.7% of the total issued Mawson Shares (after including the 1.0 million Mawson Shares from the Clonbinane acquisition).

- Secures a right of first refusal for Mawson to take up or match proposals being considered over a competitive 2,000 square kilometre tenement package held by Nagambie (Figure 1). This package includes the Nagambie Gold Mine and provides Mawson with a pipeline of potential new projects.

- Provides Mawson with a pre-emptive right on future issuances of Nagambie Shares to avoid dilution.

Mr. Hudson, Chairman and CEO, continues, "This acquisition diversifies and adds further high-quality quality gold exploration assets to the Company in another Tier 1 gold district, while we maintain a significant focus on building resources at the Rajapalot project in Finland where five drill rigs are currently operational. Our success in Finland underpins our overall strategy as a gold exploration company, while management’s long operating history in both Finland and Australia allows Mawson to bring a highly capable exploration team to continue value creation through discovery. We look forward to working in partnership with Nagambie as we both work to find Victoria’s next major gold deposit.”

Transaction Overview

Nagambie and Mawson have signed three binding Letter Agreements with respect to the above-noted transactions (collectively, the “Transaction”). The execution of final definitive agreements is targeted for on or before 10 March 2020.

1. Mawson to become a Cornerstone Supportive Shareholder in Nagambie

Mawson will subscribe for 50.0 million Nagambie Shares which will represent 10.0% of the total issued Nagambie Shares on closing of the Transaction (the “Closing Date”). The Nagambie Shares will be subject to trading restrictions for a period of two years from the Closing Date.

Provided Mawson continues to hold the original 50.0 million Nagambie Shares, Mawson will have a right of first refusal to take up or match any proposals being considered by Nagambie over its 2,000 square kilometres of tenements in the Waranga Domain. The tenement package provides Mawson with a runway of potential new projects and includes the Nagambie Mine, which was mined by Perseverance Corporation, who subsequently bought and mined the heap leach operation at Fosterville (Figure 1). Nagambie will continue to explore in the Waranga Domain using its crustal scale modelling, induced polarization geophysics and drilling to provide Mawson with exposure to potential new projects within a vast 2,000 square kilometre portfolio.

As consideration for the 50.0 million Nagambie Shares, Nagambie will receive 8.5 million Mawson Shares, which will represent approximately 4.7% of total issued Mawson Shares (after including the 1.0 million Mawson Shares from the Clonbinane acquisition). The Mawson Shares will be subject to trading restrictions and will be released from such trading restrictions in 25% tranches at intervals of 4 months, 10 months, 16 months and 22 months from the Closing Date.

2. Mawson to Purchase 100% of Nagambie’s Clonbinane Tenements

Mawson will acquire 100% of the shares in Clonbinane Goldfield Pty Ltd (“CGPL”), a 100% subsidiary of Nagambie and the holder of 62 square kilometres of mineral tenements at Clonbinane, for consideration to Nagambie of A$500,000 cash and 1.0 million Mawson Shares. Mawson will also pay Nagambie A$28,000 to replace environmental bonds. The 1.0 million Mawson Shares will be subject to trading restrictions from the Closing Date and will be released in tranches of 250,000 Mawson Shares at intervals of 4 months, 10 months, 16 months and 22 months from close.

Clonbinane is a shallow orogenic (or epizonal) Fosterville-style deposit located 56 kilometres north of Melbourne. Small scale mining has been undertaken in the project area since the 1880s with total production being reported as 41,000oz gold at a grade of 33g/t gold. Gold mineralization is hosted within, or proximal to, dykes with mineralization continuing along structures that extend into the sedimentary country rock. The diorite dyke and historic working trend continues for 11 kilometres and remains undrilled (Figure 2).

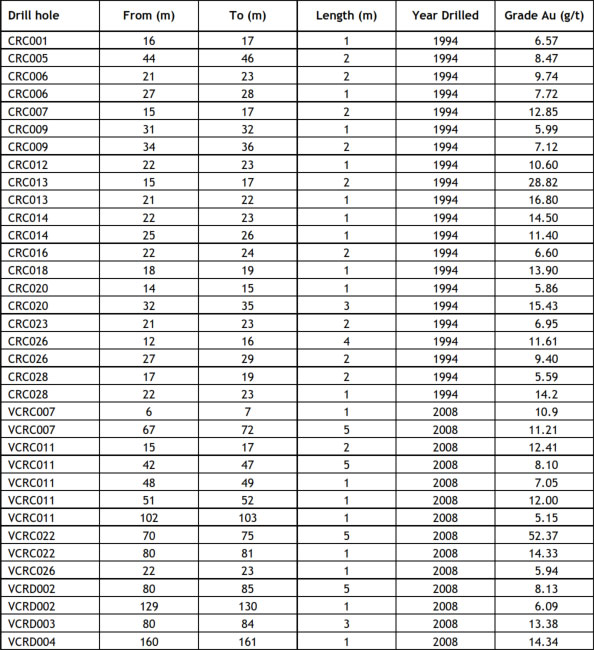

Two small drill campaigns have tested the Clonbinane mineralized system to 40-100 metres vertical depth over an 800 metre strike. In 1986, Ausminde Pty Ltd and Ausminde Holdings Pty Ltd (collectively “Ausminde”) were granted mineral tenure at Clonbinane. Ausminde’s completed soil and rock chip sampling and undertook RC drilling in 1993 (29 RC drill holes). Beadell Resources Limited subsequently drilled at Clonbinane in 2008 (30 RC holes with 7 diamond drill tails). Drilling results from both these programs greater than 5g/t gold are shown in Table 1. None of the drill data has been independently verified at this time. Compilation of available data and 3D geologic modeling are in progress. The true thickness of the mineralized intervals is not known at this stage. Selected drill results with a 0.5g/t gold lower cut from these two drill programs at Clonbinane included:

- 17 metres at 7.0g/t gold and 0.8% antimony from 66 metres (VCRC022),

- 38 metres at 2.8g/t from 15 metres (VCRC011),

- 27 metres at 3.7g/t gold and 0.46% antimony from 3 metres (CRC013),

- 2 metres at 42.5g/t gold and 1.0% antimony from 70 metres (VCRC022),

- 10 metres at 7.0g/t gold from 42 metres (VCRC011), and

- 5 metres at 11.2g/t gold and 0.78% antimony from 67 metres (VCRC007).

Clonbinane is open at depth and along strike and is considered a high value exploration project with affinity to the Fosterville Mine (Figures 3-5). Mawson will compile all historic mining and exploration data into a 3D model, and look to apply large scale, deeper seeking geophysical methods to identify large mineral systems below 40-100 metres depth.

3. Option and Joint Ventures

Mawson will have the option to earn an up to 70% joint venture interest in each of Nagambie’s Redcastle and Doctor’s Gully gold properties located in Victoria, Australia by incurring the following exploration expenditures on the each of the properties: A$100,000 in the first year and an additional A$150,000 in year 2 to earn 25%, an additional A$250,000 in year 3 to earn 50% and an additional A$500,000 by year 5 to earn 70%. Once Mawson earns 70% a joint venture between the parties will be formed. Nagambie may then contribute its 30% share of further exploration expenditures or, if it chooses to not contribute, dilute its interest. Should Nagambie’s interest be reduced to less than 5.0%, it will be deemed to have forfeited its interest in the joint venture to Mawson in exchange for a 1.5% net smelter return royalty (“NSR”) on gold revenue. Should Nagambie be granted the NSR, Mawson will have the right to acquire the NSR for A$4,000,000 per property.

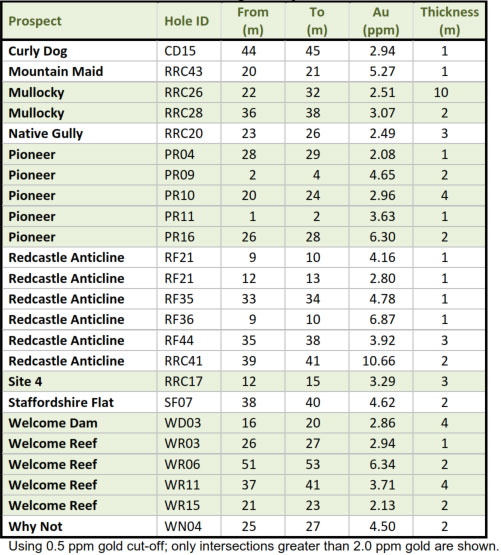

- Redcastle Option and Joint Venture Redcastle is a rural locality in central Victoria 45 kilometres east of Bendigo and 18 kilometres north of Heathcote (Figure 1). Redcastle was discovered in 1859, and named the Balmoral Diggings. 'Redcastle' a name of Scottish origin, displaced Balmoral sometime later. Underground mining continued until 1902. Redcastle is a shallow orogenic (or epizonal) Fosterville-style historic high-grade orefield held within a tenure area of 51 square kilometres. It is located 7 kilometres along strike from Mandalay Resources' Costerfield mine and on a parallel north-south structure, 24 kilometres east of Kirkland Lake Gold’s Fosterville mine. The northern margin of the claim is surround by a Newmont Corporation exploration licence. There are few historic reliable production records of the early mining at Redcastle, however very high grades of gold and associated stibnite were recorded from nearly all mines, which were only worked to an average of 55 metres depth within a 5 kilometre by 4 kilometre area. The Redcastle Gold Mining Company is reported to have produced 35,000 ounces of gold from Clarke’s Reef at a grade of 33g/t gold. Today six principal prospects or target areas have been identified at Redcastle: Reservoir, Mullocky, Laura, RFZ, Why Not and Pioneer. An RC drill program in 2007-08 by Nagambie totaled 239 holes for 10,169 metres. The average depth of drilling was 42.6 metres with the deepest hole being 81.0 metres and the shallowest hole being 5 metres deep. Of the 14 prospects drilled, 10 intersected gold greater than 1.0g/t gold in 1 metre sample intervals. Composite intersections with an average weighted grade greater than 2.0 ppm gold, using a 0.5g/t gold cut-off are presented in Table 2. None of the drill data have been independently verified at this time. Compilation of available data and 3D geologic modeling are in progress. The true thickness of the mineralized intervals is not known at this stage. Selected drill results from this drill program at Redcastle included: 10 metres at 2.5g/t gold from 22 metres (RRC26), 2 metres at 10.7g/t gold from 39 metres (RRC41) and 2 metres at 6.3g/t gold from 26 metres (PR16). Previous workers have exclusively focused on heap leachable near-surface gold at Redcastle and the project remains untested to depth. Mawson will compile all historic mining and exploration data into a 3D model, and look to apply large scale, deeper seeking geophysical methods to identify large mineral systems below 50 metres depth.

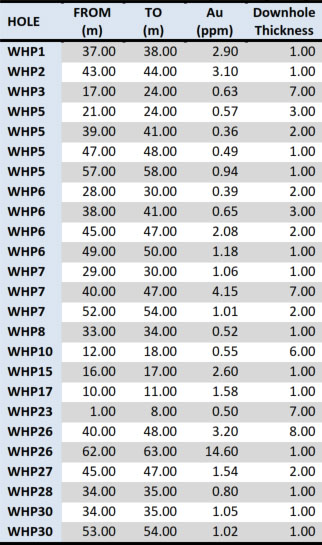

- Doctors Gully Option and Joint Venture Doctor’s Gully is a shallow orogenic (or epizonal) Fosterville-style historic mining district. The Doctor’s Gully retention license covers a smaller area of 4 square kilometres with 21 historic gold showings and mines (Figure 1). In modern times it has been mined for oxide gold. It is located 13 kilometres northeast of Redcastle. Gold Mines of Kalgoorlie (“GMK”, also working as Metals Exploration Ltd) mapped and drilled Doctor’s Gully in 1988. A total of 1,734 metres of RC drilling was conducted in 29 holes across the prospect. The results from this drill program have never been followed up. Composite intersections are presented in Table 3. None of the drill data has been independently verified at this time. Compilation of available data and 3D geologic modeling are in progress. The true thickness of the mineralized intervals is not known at this stage. Better drill intersections from this program included 7 metres @ 4.1g/t gold from 40 metres (WHP7) and 8 metres @ 3.2g/t gold from 40 metres (WHP26) and 1 metre @ 14.6g/t gold from 62 metres (WHP26). Like Redcastle, previous workers have exclusively focused on heap leachable near-surface gold at Doctors Gully and the project remains untested at depth. Mawson will compile all historic mining and exploration data into a 3D model, and look to apply large scale, deeper seeking geophysical methods to explore for a large mineral system below 50 metres depth.

Conditions to Closing

The obligation of Mawson to complete the Transaction is subject to, among other matters, Mawson being satisfied in its sole discretion with the material results of its due diligence investigation on Nagambie and its assets (to be completed on or before February 14, 2020) and receipt of TSX approval to the Transaction.

Qualified Person

Michael Hudson, Chairman and CEO for the Company, is a qualified person as defined by National Instrument 43-101 – Standards of Disclosure or Mineral Projects and has prepared or reviewed the preparation of the scientific and technical information in this press release.

None of the drill data has been independently verified at this time. These historical data have not been verified by Mawson and are quoted for information purposes only. Drilling information from Clonbinane by Ausminde and Beadell Resources, at Redcastle by Nagambie and at Doctor’s Gully by GMK had a variety of assays and check assays reported in historical reports. It is believed that the primary analysis for gold was completed by fire assay with an atomic adsorption finish by NATA registered laboratories. Assay techniques for antimony are unknown at this stage.

About Mawson Resources Limited (TSX:MAW, FRANKFURT:MXR, OTCPINK:MWSNF)

Mawson Resources Limited is an exploration and development company. Mawson has distinguished itself as a leading Nordic Arctic exploration company with a focus on the flagship Rajapalot gold project in Finland. The Australian acquisition provides Mawson with a strategic and diversified portfolio of high-quality gold exploration assets in two safe jurisdictions.

About Nagambie Resources Ltd (ASX: NAG)

Nagambie Resources Ltd (“Nagambie”) explores for Fosterville-style, structural-controlled, high-grade sulphide-gold underground deposits within 2,000 sq km of Waranga Domain tenements. Exploration is carried out using geophysical targeting techniques, diamond drilling and analysis for hydrothermal alteration of the sediments.

The Company is also evaluating:

- Underwater storage of sulphidic excavation material in the two legacy gold pits at the Nagambie Mine, capable of storing 5 million tonnes of spoil from major infrastructure projects for Melbourne such as Metro Tunnel, West Gate Tunnel and North East Link.

- Recycling of the tailings and overburden dumps to produce aggregates for concrete and gravel products respectively.

- Quarrying and screening of sand deposits at the mine to produce various sand and quartz aggregate products is planned.

| On behalf of the Board, "Michael Hudson" Michael Hudson, Chairman & CEO | Further Information www.mawsonresources.com 1305 – 1090 West Georgia St., Vancouver, BC, V6E 3V7 Mariana Bermudez (Canada), Corporate Secretary, +1 (604) 685 9316, info@mawsonresources.com |

Forward-Looking Statement

This news release contains forward-looking statements or forward-looking information within the meaning of applicable securities laws (collectively, "forward-looking statements"). All statements herein, other than statements of historical fact, are forward-looking statements. Although Mawson believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. Mawson cautions investors that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, but not limited to, capital and other costs varying significantly from estimates, changes in world metal markets, changes in equity markets, planned drill programs and results varying from expectations, delays in obtaining results, equipment failure, unexpected geological conditions, local community relations, dealings with non-governmental organizations, delays in operations due to permit grants, environmental and safety risks, and other risks and uncertainties disclosed under the heading "Risk Factors" in Mawson's most recent Annual Information Form filed on www.sedar.com. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Mawson disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.