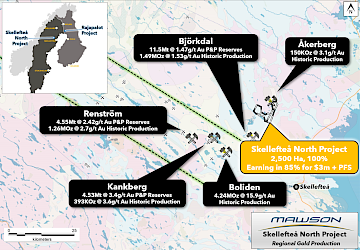

The Skellefte Belt comprises a poly-deformed, paleoproterozoic-aged volcano-sedimentary rocks containing several large gold deposits that have produced in excess of 6 Moz of gold (most notably from the Boliden, Bjorkdal and Kankberg gold mines).

Swedish mining giant Boliden has dominated production in the district for nearly a century and has established processing facilities at the site of the historical Boliden gold mine (historical production of 4 Moz at 15.1 g/t Au) located ~22 km to the southwest and smelting facilities in Skelleftea.

Mandalay Resources Corporation operates the Björkdal gold mine located 8 km to the southwest of the Project, having historically produced over 1.3 Moz Au with a further 1 Moz Au remaining in M&I resources.

The Skellefteå North Project is also flanked by the Akerberg open-pit mine located some 2 km to the northwest, which historically produced 150 Koz Au (at 3.1 g/t Au) in the early 2000’s. In addition, there are 85 known polymetallic sulfide deposits within the Skellefte Mining District, the largest being the currently-operating Renstrom and Kristineberg mines having produced over 14 Mt and 32 Mt of polymetallic sulfide ore respectively.

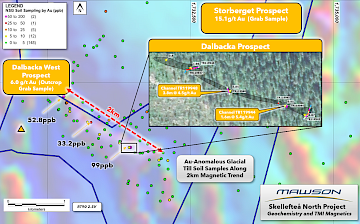

The Project area contains outcropping gold mineralization across the 3 km x 6 km land package with grab samples collected grading up to 15.1 g/t Au.